Let Your Life Flow Through You

What to do now?

10 Daily Financial Practices To Make You Stretch and Grow

Follow this link to read Kasey’s article on the Spirituality & Health site now!

Planning Retirement isn’t just a Financial Plan, The Five Accomplishments You Need

Having walked my clients through planning, approaching, and living in retirement financially for the last almost 40 years, I couldn’t help but pick up on other aspects facing us besides the money part, such as grappling with when to retire, what to do in retirement, and how to plan a full and thriving last third of life? As I heard someone say; what are you going to do between now and dead?

As we near our ‘golden years’, we observe our elders living in a great variety of ways, from scrapping by on social security, to cruising or flying around the world, and travelling between multiple homes. There is an undeniable correlation between financial health and satisfaction in the later years, but this doesn’t mean you need to be stinking rich.

A successful retirement appears to have several moving parts: financial, health and wellbeing, relationships, passions and purpose; and let’s face it, nearing death also brings in one’s beliefs and how they experience their own spiritual life. So how do we prepare ourselves for this last and significant period of our lives?

First, not planning for it or setting goals, not contemplating how you will live in retirement, can cause unnecessary suffering later on. With no plan, with no savings, with no interests outside of work, some retirees may end up spinning in their own exhaust, no where to go and nothing to do. This can be disastrous on the human spirit. Depression and other mental health problems can take hold, leading to unhappiness and even physical ailments. But let’s not dwell on this, because the fact that you are reading this means you are proactive, interested, and willing to learn. Yay you!

This topic could easily be a 400-page book, but I’m just going to give you the briefest of outlines here.

1) Financially

- Never too early or too late to begin saving. Have your paycheck debited for your employer plan, or, have your checking account systematically debited to go into an IRA, as much as you can afford, and then a little more.

- Invest in a broad, diversified portfolio with stocks and bonds, low fees and good, comprehensive management.

- Beware if you have the tendency, like some parents of adult children, to financially help them to such an extent you harm your own comfortable retirement. I remember a client who borrowed against his home, and withdrew from his IRAs, to help a daughter who said she couldn’t find a job. He did this until he and his wife had to give up their plans on traveling with their friends in retirement. He died leaving nothing for his wife, and only after his death did his daughter go to work to support herself.

- We used to say in the financial business in the 1980s, you needed at least as much in savings as your closest decade in a hundred thousand dollars. For instance, at 40 years old you should have saved $400,000, at 60, $600,000, and so on. Typical standards now in financial planning state it really takes much closer to one million to have financial freedom these days to enable no financial worries, and the ability to take care of all your needs. Yet, I have seen people retire with half that and get along just fine.

- Educate yourself on how money works; how the markets work. Order our 30 page $5.00 booklet on the 7 Big Mistakes Investors Make & The 7 Habits of Successful Investors to get you started. You will find it listed on this linked page.

2) Health and Wellbeing

- Of course, take good care of yourself. Eat a good, healthy diet with lots of fresh vegetables, fruits, nuts and lean proteins.

- Get outside every day. Walk, bike, swim, play, explore, move. Take up yoga or Tai chi, dancing or some other social exercise. These good habits will be easy to follow into retirement. With good balance falls become much less likely among many other benefits.

- Find a mindfulness practice you like such as meditation, contemplation, breathing techniques, prayer and self-reflection etc. Conditioning the mind for wellbeing is also essential.

- If you do have anxiety, depression, or other emotional problems bothering you, find a good therapist. Most of these issues are resolved with the proper help. Our society still attaches an unfortunate stigma to getting assistance in this area, but it is so essential, shows emotional maturity, self-care, and can be a rewarding experience.

- Develop a positive attitude toward aging and retirement. Day dream about all the activities and experiences you’ll be able to enjoy, and the friends and family to spend time with. If you don’t have a close circle of friends, join a club or a class. Get involved in something you enjoy, sports, a book club, knitting, hiking etc. and read, I can’t stress how much reading can enhance anyone’s life in so many ways. There are so many great books in the self-help genre, but even a great book of fiction is a positive experience.

- Cultivate peace with your own passing. Our cultures in the West have a poor record of coming to terms with death. It’s not usually spoken about except in dramatic and negative ways; we pretend it isn’t inevitable, we try to extend the lives of our loved ones in often grotesque and extreme ways, making their last days, weeks or months, lying in a sterile facility hooked up to machines and on heavy medications. My recommendation is to have a good plan. Most states have a type of Dying with Dignity form to fill out describing what you want done and how in a terminal situation. Email us if you would like us to mail you one. Other than this, building a solid belief of your own, whether religious or faith in life and nature, can re-frame the end of life as something not to fear. There are many great books on this.

3) Relationships

- Fostering good relationships takes time, effort and the ability to forgive—maybe yourself or others. We all say or do things we don’t mean at times, are hurt by others words or actions, and without processing through these productively, we can be emotionally drained, hurt or worse. Forgive yourself and others. I know it’s hard. I will never forget a ninety-six-year-old, long-time client on his deathbed telling me he had been too hard on his wife and children. He was verbally abusive. He carried this all of his life. If he had been self-reflective, brave enough to look within, and been able to forgive himself, he wouldn’t have been so full of pain at the end.

- Approaching this last stage of life, we can take the opportunity to develop a positive relationship with ourselves and others that will nurture us.

4) Passions and Purpose

- What do you envision doing during retirement? So many people have jobs they don’t really enjoy, and so they dream of retiring as soon as possible, looking forward to having endless free days, like permanent weekends. But they’ve spent little time thinking about what they will do in retirement. I’ve seen some retire in their 50s and become bored, aimless and searching. Some go back to work. Some actually lose interest if life. On the other hand, I’ve seen people in their 70s who have no intention of retiring anytime soon because they love what they are doing.

- Studies show the more control you have over what you do at work, who you work with and so on, the more satisfied you are. I believe that is why entrepreneurs often scoff at the idea of retiring, they are already living the life of their dreams.

- To discover what your perfect retirement might look like, create a vision board of activities and places you’re interested in exploring. Think about what you enjoyed as a child.

- Ask, how you may serve your community?

5) Deciding When to Retire

So, I am guessing you are beginning to see its not just at what age you can fiscally retire, it is so much more than that.

One, you want to retire when you are healthy and able to enjoy your passions

Two, you’ve figured out how you are going to fulfill your needs for community, purpose, interests and activities.

Three, make sure you aren’t just continuing to work because you have no idea what else to do with your life. Maybe you aren’t totally satisfied with work, but haven’t invested the time to explore what else might interest you.

Four, what about semi-retiring? This is getting very popular for those who have this option. And if you don’t, perhaps you could retire and pick up a part-time job doing something you’ve always wanted to do, like teach art or be in a counseling position.

Five, talk with your financial advisor about the income you will need during retirement. Take in to account how much your desired lifestyle will cost, your social security, and the amount of investments it will take to produce the income.

All of these subjects require some introspection; knowing yourself well will help you plan your later years to your benefit. Settling in to the idea of being an elder in the community, offering your hard-wrought wisdom, having loving relationships, enjoying the fruits of your labor, knowing how to still play, and exploring the world with a sense of wonder, can make your retirement the best time of your life.

Photo by Tiago Muraro on Unsplash

Money Tip: Over-Funded Retirement Accounts

Life happens pretty fast. Most of us are busy working away, adding to our retirement accounts in a company plan or an IRA. Before we know it, we’re nearing retirement. And there is something I’ve noticed about this.

It isn’t hard to build up our retirement if it’s taken out of our paychecks or checking accounts automatically. We don’t ever really miss it. But we may not find it so easy to do this with our after-tax money. Setting aside money for emergencies, other long-term savings, ready cash for vacations and big ticket items is important also.

We’ve grown accustom to instant gratification, impulsively buying things we don’t need, and we whittle away the money we could be saving in a savings or investment account apart from long-term retirement ones.

In approaching retirement, many people find they have a nice amount in their IRAs or retirement plans, yet not much elsewhere. Once in retirement, or unluckily, laid off, they find they need to not only depend on an income from the retirement accounts, but it also is the place they need to go for big expenses such as repairing big items, needing a new a/c unit, or other big costs. And if they turn 70 ½, now they have to take a significant amount out for their RMD, (Required Mandatory Distribution), because the IRS wants to tax that account you’ve had great tax advantages on for so long.

One scenario: George has $1,000,000 in his IRA. He turned 70 ½ this year and must withdraw $50,000 and pay taxes on that. He may not need it, but he has to take the distribution anyway. He could have directed some of those savings to non-retirement accounts.

Another scenario: Harry, 55, has saved $300,000 in his IRA but has only about $7,000 in savings. He needs a new roof that will cost him $15,000. He needs to take it out of his IRA, paying income tax and a 10% penalty because he is not yet 59 ½ .

The advice here is, in addition to saving for retirement, it is important to set aside other monies that is readily available without penalties or tax consequences. There are several ways to set this up automatically, much like your retirement plan at work.

- Ask your employer if they have an after-tax savings plan you can contribute to that is reasonably accessible to you.

- Set up a savings, money market, or mutual fund and direct your bank to send to this account a set amount at regular periods. Could be around your paycheck deposits.

- When you sit down to pay your bills make a point to pay yourself first. Transfer money from your bank account to your savings online.

- For extra windfalls such as a bonus, monetary gifts, inheritance, etc. save a portion.

There are more ideas, see if you can think of some. Just be aware so all your assets aren’t in a retirement account. Retirement accounts are for retirement income down the road.

Get with a financial planner and figure out a plan that will give you the income you’ll need in retirement and savings for needs while you’re working.

Photo by Fabian Blank on Unsplash

Questions and Answers for Financial Wellbeing.

Since prosperity is a component of well-being this also deserves our attention.

The definition of well-being is a good or satisfactory condition of existence; a state characterized by health, happiness, and prosperity; welfare.

Question

I have my emergency savings in place, and am starting my “fun” account, and an additional investment account. I’m wondering if there is a ratio or % that I should keep in mind when deciding what to save and what to have fun with? Signed, A.L.

(Note to readers, I wrote about the idea of the Fun account a while ago. You can find it here. But mainly it’s the account apart from survival needs. To be used for vacations, future projects, fun purchases, personal growth expenses like books, lectures, programs and retreats, life enhancing stuff, and of course your dreams!)

Answer

First of all, congratulations on completing one of the standards of financial health, insuring against financial risk by saving for emergencies. Things can happen, and even though we are all creating intentions for a comfortable life full of purpose and joy, change comes unexpectedly. Layoffs, auto repairs, home repairs, and other surprises present themselves. Having that 4 to 6 months of income needs set aside is such a relief when it is necessary. And just having that in an account, seeing it on a statement periodically, gives us a feeling of accomplishment. That feeling is a component of wellbeing.

Now it’s time for you to develop your own financial plan. Begin with the desired end result in mind. Don’t worry if you don’t know some of the answers right now, most likely your prosperity plan will be a living, growing piece of your life that will shift and change along with you. Your money is a representation of your efforts, desires, and goals. It will snap to your intentions as you develop confidence in this area.

First define your short-term (1-3 years), intermediate-term (up to 10 years, or to use any time before retirement) and long-term goals.

Examples:

Short-term could be things like the need for new car soon, job uncertainty, year-end property taxes, etc. and the emergency fund should take care of this.

Intermediate-term could be your plans for a special trip, self-care, fulfillment and service.

Long-term, of course would be kid’s college funding or/and retirement plan and estate plan needs. Here is a nice way to calculate your retirement needs based on your income by JP Morgan. I like this one because it isn’t one size fits all. It is based on a percentage of your current income. If you’re 35 and make $50,000, according to the chart, you should have 90% of that, or $45,000 in a retirement account so far.

Your emergency, short-term account is completed, (GREAT!) that leaves your intermediate and long-term accounts to fund.

$458 a month into an IRA would max out your contribution limit. It is fully deductible if your income is under $63,000, even if you are also covered under a 401k. If this is comfortable for you, start this now. Whatever is left after your bills are paid, put in your bank savings until it is a few thousand and then invest that for the intermediate savings. If you have $1000 from your paycheck left in the bank at the end of the month, roughly half will go into retirement and half into intermediate, or FUN account.

And name them whatever you want. Get creative!

Short-term account >4 years

Essential to get this done before the Fun account

Nickname: example, Allowing for Uncertainty Account

Ideal Amount: equal to 4 to 6 months income. $50,000 income would be $16,000 to $25,000

Keep in a bank savings or money market account. When you need to use it make it a priority to build it back up.

Intermediate FUN Account up to 10 years

Nickname: example, Intentions, Dreams and Goals Account

Ideal amount: figure the cost of each dream and add them up. This is for FUN. There are no strict rules, this may be used whenever. After your IRA and emergency accounts are being funded, your bills are covered, divert your new funds to this account. Use a bank savings account, money market or short-term investments.

Long-Term Account

Nickname: True Prosperity Account

Ideal Amount: Enough to generate at least 75% of income needs. Figure on taking withdrawals of 5% from your investment account annually. For example, each $100,000 saved will produce $5,000 a year. Or use the calculator mentioned above on how much you need to be saving a year based on your income now.

Maximize your employer’s plan, at the minimum contribute the amount they will match, that’s free money!

It’s impossible to address all the details and different situations in a short answer. I hope this gives you an idea on how to begin. To fine-tune your plan, especially if you have children to educate or older parents to care for, it is always best to find an advisor you can trust to help you navigate all these circumstances.

As always, pay yourself first. Get these accounts set up and growing! As you watch them increase, your motivation will grow too! You will be financially free! And to me, that means you do what you want, when you want, and have all that you need. And you can also take the Money Map Quiz to see your strengths and next step to gain more competency financially.

Play Yourself Some Money

Many people find me and my site because they’ve googled money quizzes or money health, or something along the order of improving their financial life. I realize this and yet find myself going back to wellbeing over and over again. I have to pull myself back from that because I understand how important this is to people.

People think having lots of money will solve their problems; having lots of money will ease stress, make their lives more attractive and make them happier.

I’d like to address this, and how a healthy approach to money is imperative to making peace with the subject of money. It is the feelings of lack, the wishing, the grasping, the neediness that makes us suffer. Not our bank account balance. After all, most of us will eat today and tomorrow. Most of us have a dry, warm place to sleep. Therefore, the angst and despair over the idea of not having enough is where our suffering originates.

Some of the happiest people in the world have very little in the way of possessions and luxuries. It isn’t money that creates happiness and wellbeing.

The grasping and angst could be just what is wrong.

Avoiding learning about money

Holding a belief money is really hard to attain

Thinking wealthy people must be shady

Or, we don’t deserve it

Etc.

We all know these concepts.

But what about this. Money is just a game. Some people know how to play the game better than others. They don’t take it so seriously. It could be their hobby. Challenging themselves to up their game to find a better paying job, or have a hobby that enables them to sell a product or a service, saving the extra cash.

It feels like a game to see how much can be put away each month in a savings or investment account.

It feels like a game to figure out what kind of trip you really want to go on and make a vision board about it, save toward it, and revisit imagining it often.

It feels like a game creating crafts around your vision, like the ‘Fun Account’ check book cover I showed on my money blog. I drew places I wanted to visit and words like, “unlimited” on it.

What are other ways you can make creating money playful? Asking the question will begin the movement of change.

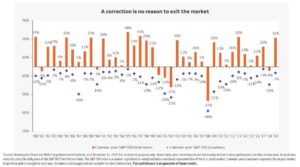

Market Crashing? Testing….

Kasey Claytor

How to Increase Your Income

This is a topic I live daily, but don’t talk about much. I’ve incorporated these key practices for so long, they are my normal state, so I forget others would really like to know them! Everyone wants more wealth. Integrating these following practices, one by one, or a few at a time, until they become habitual, feel comfortable, will get you on your way. You don’t need to do special affirmations, writing them on your mirror, (though I’ve done that) follow 100 gurus and teachers to discover success, or your purpose; just develop good daily practices that make you stretch and grow.

I was very fortunate to have a wonderful childhood of contrasts. For the first 11 or 12 years of my life we were in prosperity, though I had no idea of that concept. In my world it was just the way it was. Then, my father lost his business and we fell into poverty. Looking back, it was a remarkable occurrence, for, if that had not happened, I wouldn’t have a clue how other ways of living were. It also gave rise to my impetus to recreate the prosperity we once experienced. I went through more poverty as a young adult, yet believed it was temporary. It was.

- Examine your beliefs regarding wealth and money, and your feelings about the success of others

You already know this; when envy pops up, when you judge other’s success harshly, when you find yourself bashing the wealthy, you know it holds you back from your success. It may be that you don’t consider it possible for yourself. False notion. If you think being wealthy, (which by that I mean a sense of freedom in doing and having what you want and need), is somehow sinful, you need to reframe that belief. Just like you can change a memory, choosing the positive parts it offers, instead of dwelling on the negative, you can shift your past, its effects, and ultimately your expectations. As it has been said many times, your being poor doesn’t help anyone.

Practice praising others success, be happy for them

- Assume and expect

Build that expectation that you will succeed. Live in the world where you have already reached your goal and watch reality catch up. Assume in your words and manner you have already arrived. But be humble! Be dignified! You have what it takes. You know you do!

- Don’t get comfortable with mediocre

I see this all the time. People settling. It is one of the biggest causes of unfulfilled desires. People stagnant. They don’t believe they can do better, so they don’t try. They make do, accepting a so-so existence. You know you can do better. Butt-kicking time! I’ve done that many times myself. No self-pity.

- Pay yourself first

A big cause of financial failure is lack of knowledge about money. No excuse. No matter how much you make, you can begin to put aside even a small amount, every payday, every month, before you pay your bills. When it grows enough to invest, find a good financial advisor and begin investing. Have your checking account debited every month to go into your mutual fund. Watching it grow will shift you in magical ways. If you don’t have enough to do this, never, I mean never, quit looking for a better paying job, or start a business!

- Read & find stillness

Educate yourself. Reading does many great things, among them increasing your knowledge, raising your IQ, developing better problem solving skills, increasing your grey matter, raising your consciousness, and training your mind in new and wondrous ways. And meditate. Benefits abound.

- Fear + action = self-esteem

This is from my daddy. He told me you never grow if you don’t stretch into unfamiliar land. Enough said.

- Go for wellbeing

All the best advice out there will inevitably lead you to wellbeing. This is my thing, my focus for my life: health, happiness, peace, prosperity, and enlightenment.

- Giving and receiving

The ability to give and receive is crucial to a satisfied, happy life. Inviting both with open arms keeps the flow going. Abundance will dance through your life like a great ballet.

- Gratitude

A key for many successful people. Being grateful everyday invites more into your life to be grateful for.

- Baby steps

Be gentle with yourself. Take small steps. Withhold judgement. Forgive yourself. Do your best. Start over. Every time. There is no finish line.